5.1RESULTS SUMMARY

2018 is the first financial year for the company that coincides with the calendar year. It began on January 1 and ended on December 31.

The previous year was a short transition period of six months, between July 1 and December 31, 2017. To facilitate the comparison with the 2018 financial year, pro forma figures have been taken for the 12 months pertaining to the 2017 calendar year.

16,500

LPG points from those acquired from Repsol in 2016 have been converted to natural gas

7%

In 2018, ebitda increased 7% due to the operational efficiency that enabled revenues to be increased and costs to be reduced

2018, with 11 TWh of natural gas transported by our network, has been a record year in the history of MRG. Low temperatures during the winter months in the Madrid region were the main cause of the increase in the demand of our domestic customers. Similarly, the efforts made by investment and sales to offer this alternative as a source of efficient and sustainable energy in the tertiary and industrial sector has borne fruit, as demand has increased in both sectors within our area of influence.

The company’s growth strategy continues to be profitable and sustainable expansion in our territory and in adjacent territories. More than 903,000 total supply points have already been created, of which more than 879,000 are natural gas.

Around 16,500 of the LPG points that we acquired from Repsol Butano in 2016 have already been converted to natural gas. MRG successfully distributes and markets LPG in the points pending conversion.

MRG maintains its operational efficiency. In this sense, it is worth mentioning the effort that the company is making in combating fraud, which will minimize gas losses in the network. At the same time, special attention is being paid to the improvement of services for our customers through the advantages offered by digitization and artificial intelligence tools.

Another major cornerstone of the company is financial strength, since it allows us to take advantage of market growth opportunities, make the necessary investments to achieve greater operational efficiencies and improve service levels, and maintain a strong social commitment to create value in all our interest groups.

The consortium of company shareholders has not changed during the year. For them, MRG represents a long-term value creation project where they share the same strategic vision and a commitment to long-term financial strength. The confidence of our company shareholders is crucial since it provides us with the necessary resources to develop our project.

The main activity of MRG is the distribution of natural gas, which is a regulated activity. Therefore, stability in the long-term regulatory framework is important, enabling the interest of necessary investments to guarantee and expand the distribution of natural gas. In this sense, the company operates in a stable, transparent and sustainable framework. The data published on the closure of the 2017 gas system tariff deficit, as well as the forecasts for 2018, show the sustainability and expertise achieved by the system in recent years.

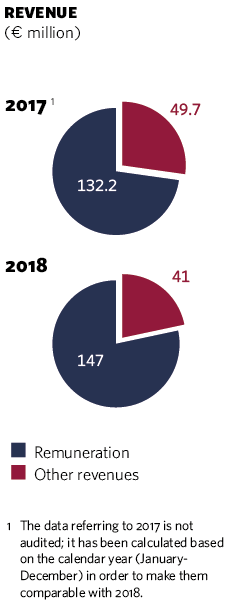

| 2017 1 | 2018 | 1The data referring to 2017 is not audited; it has been calculated based on the calendar year (January-December) in order to make them comparable with 2018. 2Excluding non-recurrent expenses. |

| Remuneration | 132.2 | 147.0 |

| Other revenues | 49.7 | 41.0 |

| EBITDA2 | 131.8 | 141.4 |

| EBIT | 97.3 | 110.6 |

| Net profit | 38.6 | 51.0 |

5.2OPERATIONAL RESULTS

2018 has seen excellent results. Our revenue figure has grown by 3%. Remuneration for the distribution activity has increased owing to growth in demand and connection points. However, this growth has been partially offset by the loss in the rental of meters for domestic use, which has entailed the lowering of rates that came into effect at the beginning of the year.

The increase in revenues and lower costs arising from operating efficiencies explain the EBITDA increase by 7 %.

5.3INCOME

The net amount of turnover in the 2018 financial year was € 188 million, 3% more than the previous year. Of the total income, excluding income from LPG sales of 18.3 million euros, 87% comes from the remuneration recognized for the distribution activity, established pursuant to the Order of the Ministry of Energy, Tourism and Digital Agenda 1283/2017, published in Official State Gazette No. 314, of December 27, 2017, which establishes the remuneration for regulated activities in 2018 and the Ministry of Environment Order 1367/2018, published in the Official State Gazette No. 308, of December 20, 2017 that includes adjustments for 2018 and previous years. The remaining 13% refers to provision from other services related to natural gas distribution activity. These include income from the rental of meters, periodic inspections and provision of other services to users.

188

Total revenues for this 2018 financial year were € 188 million, 3% more than the previous year

5.4FINANCIAL POSITION AND BALANCE

During 2018, € 500 million of bonds were redeemed on their maturity date. The redemption was paid with the funds obtained in 2017 for the issue of bonds for an amount of € 600 million by Madrileña Red de Gas Finance BV, a company domiciled in the Netherlands and one hundred percent owned by the sole shareholder of Madrileña Red de Gas.

After this operation, the resulting debt is lower and its average cost has improved, which has gone from 3.1% to 2.7%. It has also increased its average life to currently 7.1 years, and has a dispersion in maturities that reduces the risk of refinancing.

500

Million euros in bonds have been redeemed during 2018 as of the due date

2.7%

The average cost of debt has improved in 2018 decreasing from 3.1% to 2.7%

7,1

The average life of the debt in 2018

MRG also has a contingent credit line for a total of € 200 million. Maturing in 2022, it allows us to increase our liquidity position with absolute flexibility.

At the end of 2017, MRG, like other operators in the sector, securitised the tariff deficit, which was 45 m€ from 2014. Similarly, during 2018, the tariff deficits for 2015 and 2016 have been securitised.

Financial strength is an essential pillar in MRG. The company has and pursues strong levels of solvency and liquidity consistent with an investment grade rating. The financial structure is efficient and long-term. Dividend flexibility is another feature that gives the company a better financial position.

Both the company and all the debt issues have been rated by the rating agencies Standard & Poor’s and Fitch with the investment grade. Both agencies have recently reaffirmed their rating.

| € million | 20172 | 2018 | 1In accordance with the International Financial Reporting Standards (IFRS). 2The data referring to 2017 is not audited; it has been calculated based on the calendar year (January-December) in order to make them comparable with 2018. |

| Gas distribution licences | 740.3 | 748.4 |

| Net tangible fixed assets | 379.3 | 358.5 |

| Total Network Fixed Assets | 1,119.6 | 1,106.9 |

| Goodwill | 57.4 | 57.4 |

| Deferred tax asset | 27.2 | 24.9 |

| Other non-current assets | 6.0 | 1.9 |

| Current assets | 62.1 | 55.8 |

| Cash | 616.0 | 63.0 |

| Total Assets | 1,888.4 | 1,309.9 |

| Equity | 304.8 | 233.3 |

| Long term debt | 1,459.1 | 942.6 |

| Deferred tax liability | 40.4 | 50.2 |

| Other non-current liabilities | 25.7 | 24.1 |

| Current liabilities | 58.5 | 59.7 |

| Total Liabilities & Shareholders equity | 1,888.4 | 1,309.9 |

5.5OPERATIONS CASH FLOW

Cash flow from ordinary operations was € 116 million, 13% higher than the one generated in the previous year, mainly owing to EBITDA growth.

13%

The percentage by which cash flow from the company’s ordinary operations has increased

The figure excludes non-recurring items related to the acquisition of LPG points to Repsol, the securitisation of the 2014 deficit in 2017, and the securitisation of deficits for 2015 and 2016 in 2018.

| 20172 | 2018 | 1In accordance with the International Financial Reporting Standards (IFRS). 2The data referring to 2017 is not audited; it has been calculated based on the calendar year (January-December) in order to make them comparable with 2018. 3Excluding one-off operations (deficit monetization in 2017 and 2018 plus VAT collection of LPG supply points acquired in 2017). |

| EBITDA | 131.8 | 141.4 |

| Income tax paid | (7.5) | (5.9) |

| Working capital3 | (2.4) | (3.9) |

| Capex | (19.2) | (15.1) |

| Free cash flow3 | 102.7 | 116.5 |

5.6INVESTMENTS

Madrileña Red de Gas has continued to implement its investment plan, with the objective of expanding the distribution of natural gas to the greatest number of consumers in its territory. The investment in fixed assets during the year reached a figure of € 15.1 million. In view of its key specifications, the investments or investment commitments in 2018 can be grouped into three broad areas:

EXPANSION

MRG has invested a total of € 9.3 million in the expansion of its distribution networks. The company’s strategy continues to focus on profitable and sustainable growth in our distribution network, both by connecting new customers within our territory and by extending them to new adjacent municipal districts.

The fact that an important part of the organic growth of 2018 comes from the conversion to natural gas of LPG points, which requires a lower investment per supply point, is the cause of the lower capex in expansion compared to other years.

OTHER PROJECTS

During 2017 and 2018, the company invested in artificial intelligence tools, digitalization, process automation and development of information systems, as well as the fight against fraud.

Through these investments, we will continue to improve operational efficiency, service levels and fight against fraud.

NON-RECURRING

In 2017, there were non-recurrent investments channelled into the sectorization of the company’s networks. In 2018, no significant investments were made in this section.